The Week In NEPSE: A Deep Dive Into Market Performance (Jan 5 – 9, 2025)

January 11, 2025 | by Nepal Majhi

A quick look at NEPSE’s market performance this week (Jan 5-9, 2025). Key insights summarized.

Welcome to our weekly summary of the Nepal Stock Exchange (NEPSE), where we take a closer look at how the market performed from January 5 to 9, 2025.

This blog post highlights key movements, sector performance, notable stocks, and the overall sentiment of the market during this period. Whether you’re a seasoned investor or a market enthusiast, understanding the week’s performance can help you make informed decisions moving forward.

Market Overview

The NEPSE index experienced notable fluctuations throughout the week. Opening on January 5 at a level of 2586.08 points, the index saw a steady increase in the early days, peaking on January 7 at 2672.15 points. However, a slight correction on January 9 brought the index down to 2635.09 points, closing the week with a modest +48.86, +1.89% gain and volume of 30.264B.

Overall, the market displayed in a sideways. NEPSE is fighting to make higher low at 2497 in a weekly chart. again it need to claim 2684 to go further-up otherwise the range at level is 2497 to be watch for the support area.

Sector-wise Performance

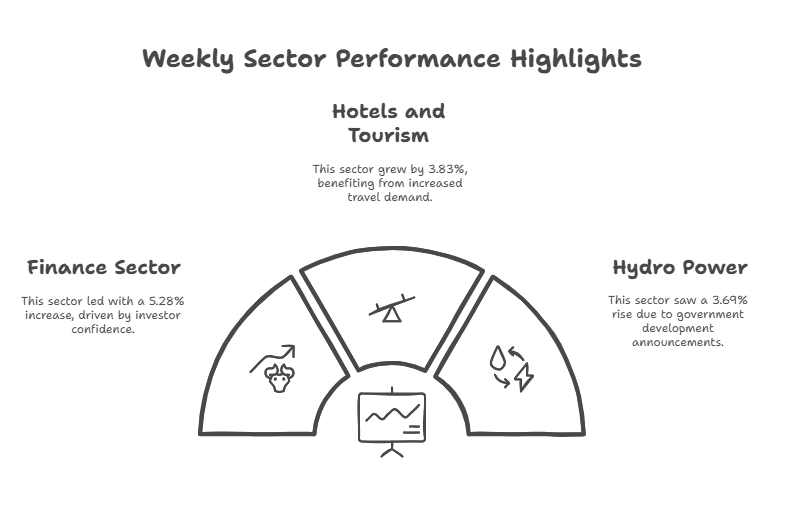

Top Performing Sectors

This week, the Finance sector emerged as the clear leader, with stocks such as SFCL, RLFL and GMFIL showing impressive growth. The sector surged by +5.28% driven by increased investor confidence in the financial stability.

Similarly, the Hotels And Tourism closed with +3.83%, Hydro Power sector saw significant movement closed with +3.69%. reaching new highs, influenced by government announcements related to hydropower development and increased electricity exports to neighboring countries.

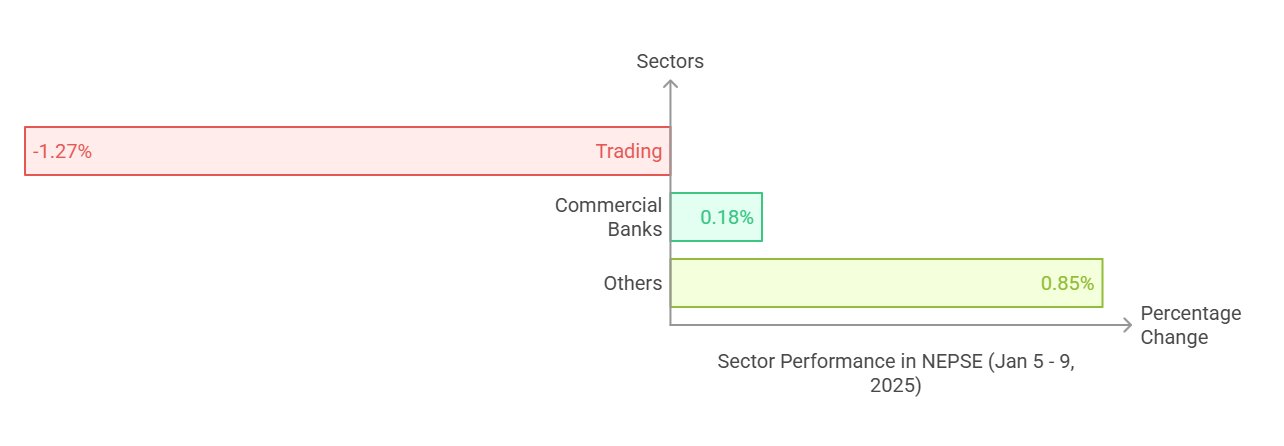

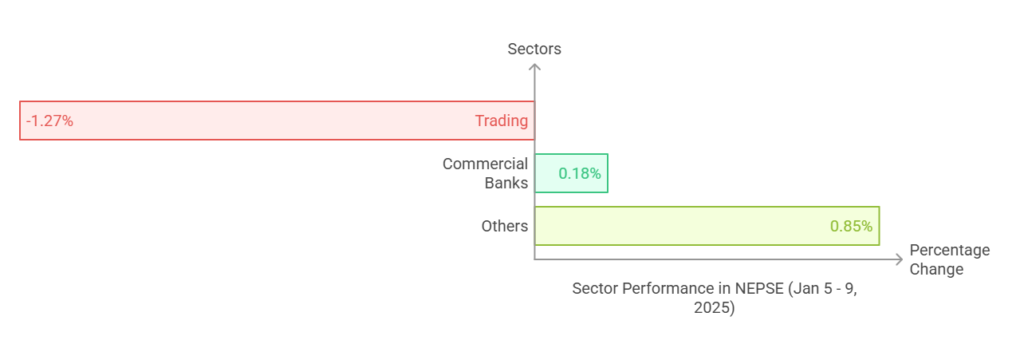

Underperforming Sectors

On the flip side, the Trading sector experienced a decline of -1.27%. with stock prices of companies like Salt Trading Corporation dropping by -0.50%.

Similarly, the Commercial Banks close with small gain of +0.18% and Others sector manage to close in a positive +0.85%.

Notable Stocks and Companies

Top Gainers

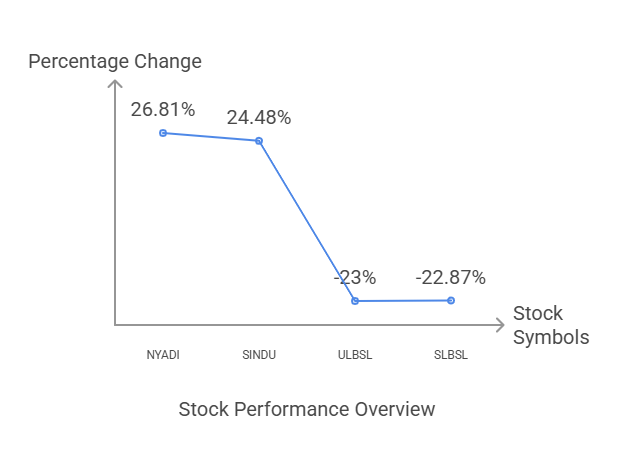

- NYADI saw a significant rise of +26.81%.

- SINDU also surged by +24.48%, with investors optimistic about its future growth prospects.

Top Losers

- ULBSL was one of the biggest losers of the week, with a decline of –23%.

- SLBSL dropped by -22.87%.

Volume and Liquidity

This week, trading volumes saw a slight increase compared to the previous week. The average daily trading volume stood at 6.062 Arba.

Liquidity remained relatively stable, with some days showing higher-than-average activity in the banking and energy sectors. The market maintained a balance between buyers and sellers, though caution was evident as some sectors faced volatility.

Top turnover sectors

Hydro Power sector close at 3674.62 with weekly Turnover Values 14 Arba, Finance sector turnover Values 3 Arba and Development Banks sector 3 Arb.

Conclusion

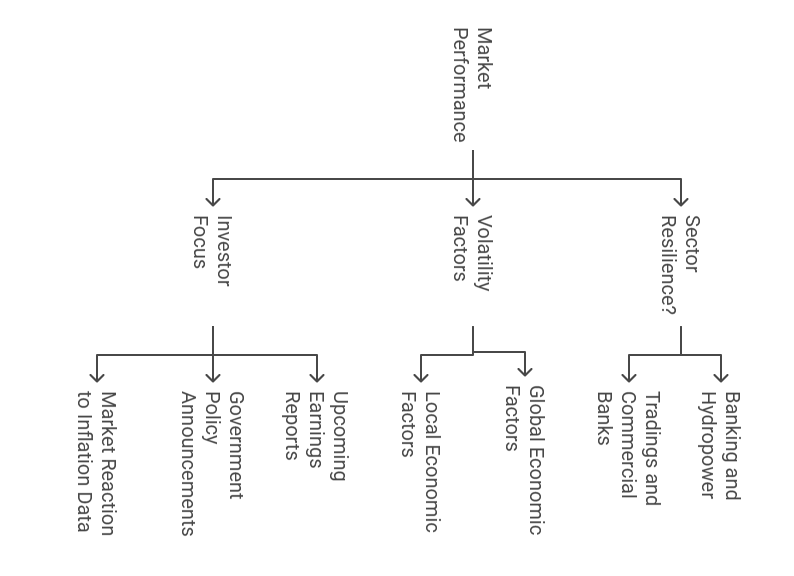

In conclusion, the week of January 5-9, 2025, presented a mixed bag of performances in the NEPSE. While some sectors like banking and hydropower showed resilience, others like Tradings and Commercial Banks struggled. Global and local economic factors continue to create volatility, keeping investors on edge.

For next week, the focus will likely be on upcoming earnings reports, government policy announcements, and market reaction to inflation data. It’s crucial for investors to remain adaptable and stay informed about both local and global developments.

What do you think about the market movements this week? Share your thoughts in the comments below, and don’t forget to subscribe for more weekly updates on NEPSE.

Read this post to get started.

RELATED POSTS

View all