All blog posts

Empowering investors and traders in Nepal with simplified stock market insights. Discover trends, analysis, and reports to make informed financial decisions.

Unveiling Nepal’s Blue-Chip Stocks: Your Top Picks for 2025

January 16, 2025 | by Nepal Majhi

Primary and Secondary Markets in Nepal: What’s the Difference?

January 14, 2025 | by Nepal Majhi

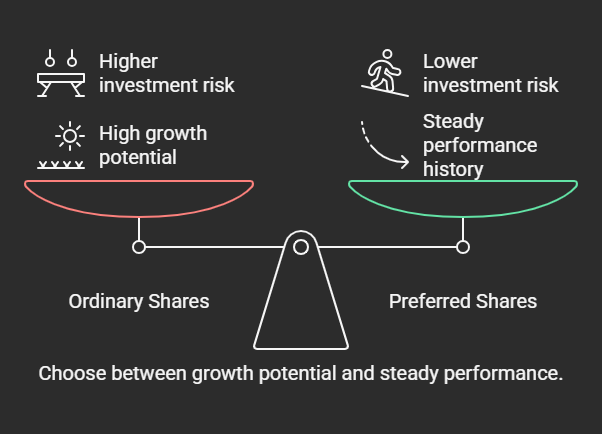

Preferred Or Ordinary: Which Shares Offer You The Edge In Nepal?

January 12, 2025 | by Nepal Majhi

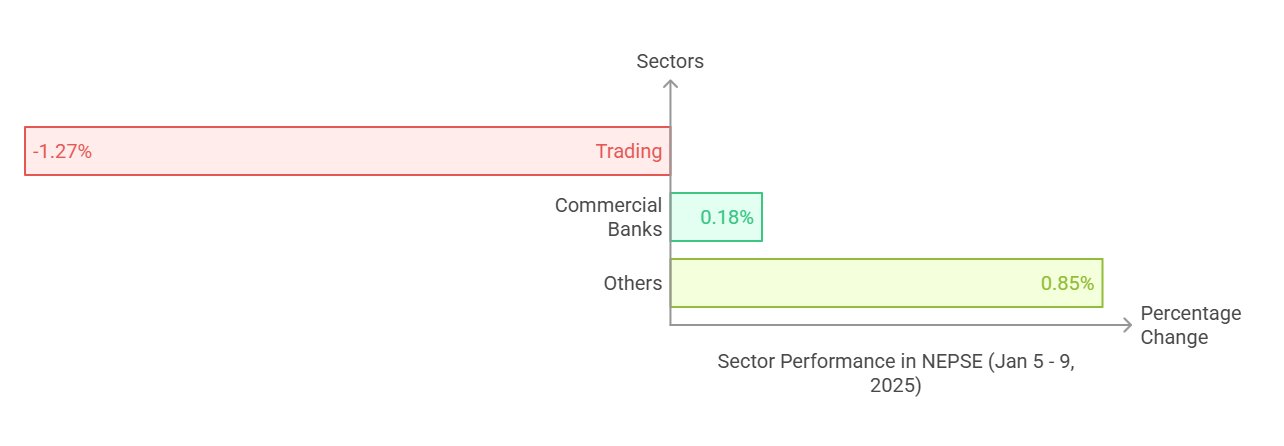

The Week In NEPSE: A Deep Dive Into Market Performance (Jan 5 – 9, 2025)

January 11, 2025 | by Nepal Majhi

Mastering NEPSE: Simplified Stock Analysis for Smarter Investments in Nepal

January 6, 2025 | by Nepal Majhi

Investing in Nepal for 2025? Discover the power of blue-chip stocks! This guide breaks down what these reliable investments are and highlights key Nepali companies to watch.

What are Blue-Chip Stocks? (The Rockstars of the Stock Market)

Imagine the most established, well-known, and financially sound companies in Nepal. These are your blue-chip stocks. They’re like the rockstars of the investing world – they’ve been around for a while, have a proven track record, and are generally considered safer investments compared to smaller, newer companies.

Think of companies that are household names, leaders in their respective industries, and have a history of consistent growth and profitability. These are the hallmarks of blue-chip companies.

Key Characteristics of Blue-Chip Stocks in Nepal:

- Large Market Capitalization: These companies have a large total value of all their outstanding shares.

- Established Track Record: They have a long history of stable earnings and dividend payments.

- Strong Financial Performance: They demonstrate consistent profitability and financial strength.

- Market Leadership: They are typically leaders in their industry or sector in Nepal.

- Lower Volatility: Their stock prices tend to be less volatile compared to smaller companies, offering more stability to your portfolio.

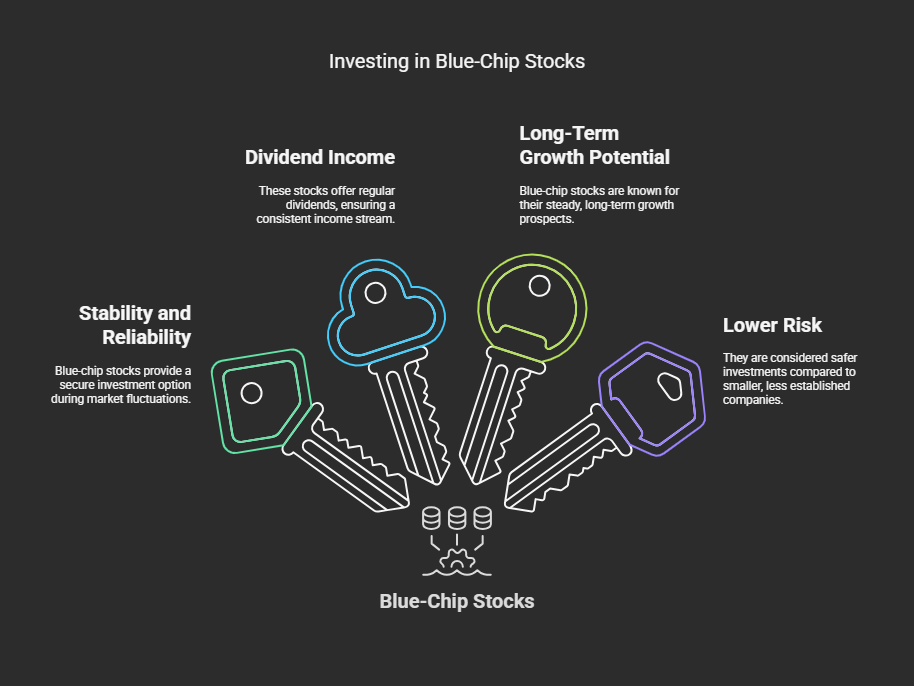

Why Invest in Blue-Chip Stocks in Nepal?

- Stability and Reliability: Blue-chip stocks offer a sense of security during market downturns.

- Dividend Income: Many blue-chip companies regularly pay dividends, providing a steady stream of income for investors.

- Long-Term Growth Potential: While not offering explosive growth like some smaller companies, blue-chips still offer steady long-term growth potential.

- Lower Risk: Compared to smaller, less established companies, blue-chips are generally considered less risky investments.

Top Blue-Chip Stock Considerations for Nepal in 2025 (Important Note):

It’s crucial to understand that I cannot provide specific financial advice or guarantee future performance. The following are examples of the types of companies that often exhibit blue-chip characteristics in the Nepali context, and should be considered for further research.

This is not a recommendation to buy or sell any specific stock. Always conduct your own due diligence or consult with a qualified financial advisor.

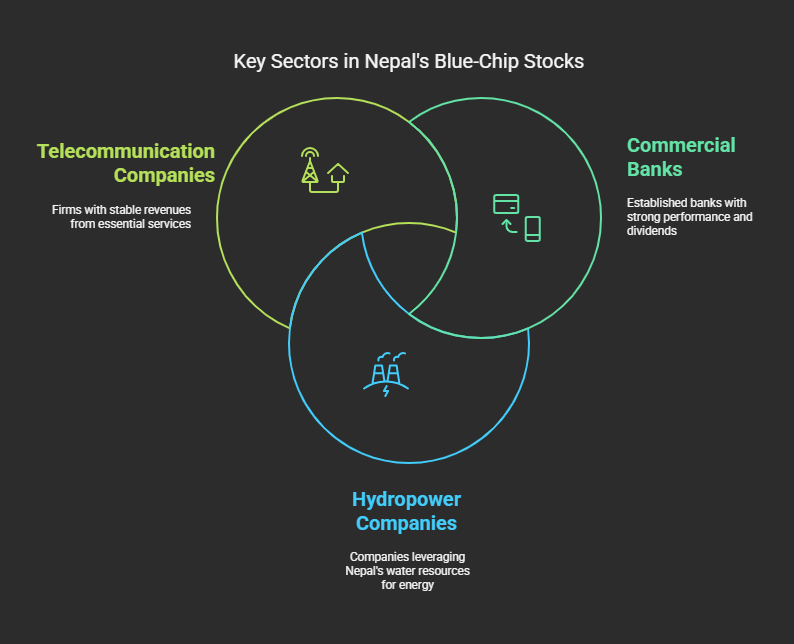

- Commercial Banks: Look for well-established commercial banks with a wide network, strong financial performance indicators, and a history of dividend payouts. These institutions are vital to Nepal’s economy and often display blue-chip characteristics.

- Hydropower Companies: Given Nepal’s abundant water resources, established hydropower companies with operational projects and power purchase agreements can be considered.

- Telecommunication Companies: Companies providing essential communication services often have a large customer base and stable revenue streams.

Things to Consider Before Investing:

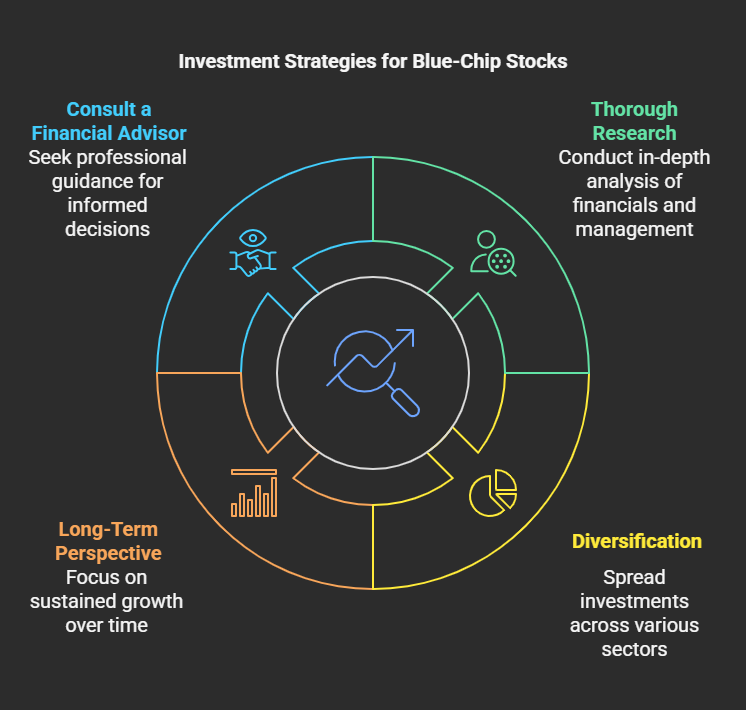

- Thorough Research: Don’t just rely on a company’s reputation. Conduct thorough research on their financials, management, and future prospects.

- Diversification: Even with blue-chip stocks, it’s crucial to diversify your portfolio across different sectors.

- Long-Term Perspective: Blue-chip stocks are generally best suited for long-term investors.

- Consult a Financial Advisor: If you’re unsure about investing, seek advice from a qualified financial advisor in Nepal.

Investing in Nepal in 2025:

As Nepal’s economy continues to develop, investing in blue-chip stocks can be a smart strategy for building a stable and growing portfolio. By focusing on established, financially sound companies, you can mitigate risk and participate in Nepal’s economic growth.

In Conclusion:

Blue-chip stocks offer a solid foundation for any Nepali investor’s portfolio. By understanding their characteristics and conducting thorough research, you can make informed investment decisions and work towards achieving your financial goals in 2025 and beyond.

What are your thoughts on blue-chip investing in Nepal? Share your questions and insights in the comments below!