Preferred Or Ordinary: Which Shares Offer You The Edge In Nepal?

January 12, 2025 | by Nepal Majhi

Hey there, fellow investors! So, you’re looking to dip your toes (or maybe dive headfirst!) into the Nepalese stock market? That’s fantastic! But with so many options available, it can get a bit overwhelming. Today, let’s tackle a common question: Preferred or Ordinary shares – which one gives you the edge in Nepal?

Think of it like choosing between two types of vehicles. Both will get you to your destination (hopefully with some profit!), but they offer different experiences.

Let’s start with Ordinary Shares – The Classic Choice:

These are the most common type of shares you’ll encounter. When you buy ordinary shares, you become a part-owner of the company. This means:

- Voting Rights: You get a say in important company decisions, like electing the board of directors. Think of it as having a vote in how the company is run.

- Dividends (Maybe): Companies may distribute a portion of their profits to shareholders as dividends. However, this isn’t guaranteed and depends on the company’s performance. It’s like a bonus – nice to have, but not something you can always count on.

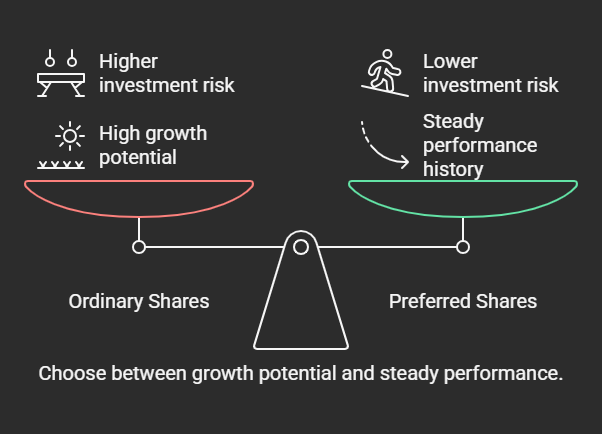

- Higher Risk, Higher Potential Reward: If the company does well, the value of your shares can skyrocket. But, if things go south, you could lose a significant portion of your investment. It’s a bit like taking a scenic mountain road – breathtaking views, but also some steep drops.

Now, let’s talk about Preferred Shares – The Steady Eddie:

These shares are a bit different. They’re often seen as a hybrid between stocks and bonds. Here’s the lowdown:

- No Voting Rights (Usually): You generally don’t get a say in company decisions. You’re more of a silent partner.

- Fixed Dividends: Preferred shareholders usually receive a fixed dividend payment, which is often paid out before any dividends are given to ordinary shareholders. This makes them more predictable income generators. It’s like having a regular paycheck – reliable and consistent.

- Less Volatility: Preferred shares tend to be less volatile than ordinary shares, meaning their prices don’t fluctuate as much. This makes them a more stable investment option. It’s like driving on a well-paved highway – smooth and predictable.

So, Which One is Right for You in Nepal?

Well, it depends on your investment goals and risk tolerance.

- If you’re looking for higher potential returns and are comfortable with more risk, ordinary shares might be a good fit. You’re essentially betting on the company’s growth.

- If you prioritize stable income and lower risk, preferred shares could be a better option. You’re prioritizing consistent returns over the potential for explosive growth.

Think of it this way:

- Ordinary Shares: Like investing in a promising startup with high growth potential but also higher risk.

- Preferred Shares: Like investing in a well-established company with a history of steady performance.

Consider these factors in the Nepalese context:

- Market Maturity: The Nepalese stock market is still developing, which can lead to higher volatility. This might make preferred shares more attractive to risk-averse investors.

- Company Specifics: Always research the specific companies you’re considering investing in. Look at their financial performance, management, and future prospects.

In Conclusion:

There’s no one-size-fits-all answer. The best choice for you depends on your individual circumstances. By understanding the key differences between preferred and ordinary shares, you can make informed investment decisions and navigate the Nepalese stock market with greater confidence.

Ready to take the next step?

- Start your research: Explore listed companies on the Nepal Stock Exchange (NEPSE) and analyze their financial data.

- Talk to a professional: Consider consulting with a financial advisor in Nepal who can provide personalized guidance based on your financial situation and goals.

- Stay informed: Keep up-to-date with market trends and news related to the Nepalese economy and stock market.

Remember, investing involves risk, so always do your due diligence and invest within your risk tolerance. Happy investing!

Disclaimer: I’m just a friendly guide, not a financial advisor. Always do your own research and consult with a qualified professional before making any investment decisions.

RELATED POSTS

View all