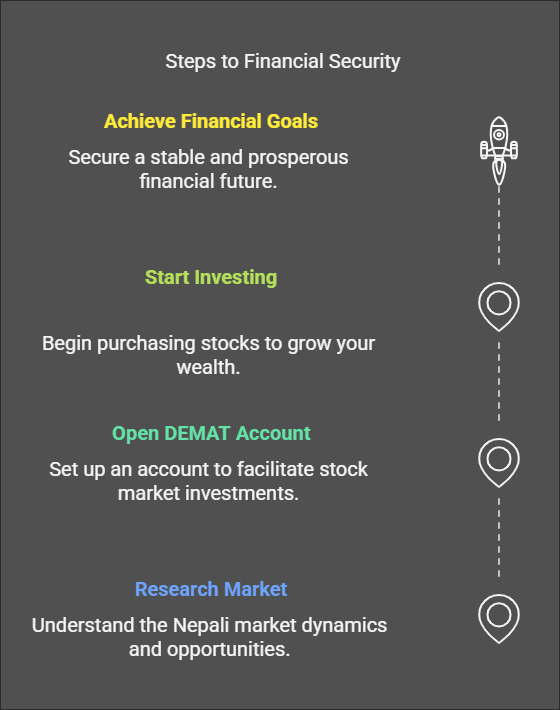

Ready to tap into Nepal’s thriving stock market? This DEMAT Guide for Expats empowers Overseas Nepalis to start investing in Nepal’s promising future and grow their wealth.

So, you’re a Nepali living abroad, hustling hard, and dreaming big? You’re not just building a life overseas, you’re building a future back home. And what better way to secure that future than by investing wisely in the Nepali market?

But where do you even begin? Especially when you’re miles away?

Good news! Opening a DEMAT account is now easier than ever, thanks to online platforms offered by companies like Naasa Securities, Capitalmax, and others. This is a game-changer for overseas Nepalis, making investing in Nepal accessible from anywhere in the world.

Enter the DEMAT account

Think of it like your digital locker for stocks, bonds, and other securities. No more physical certificates gathering dust in your safety deposit box. With a DEMAT account, all your investments are recorded electronically, making trading and tracking your portfolio a breeze.

Why should you care?

- Convenience: Trade anytime, anywhere, with an internet connection. No more waiting for market hours or dealing with paperwork.

- Safety: Your investments are secure and protected from fraud and theft.

- Transparency: Track your portfolio’s performance in real-time and make informed investment decisions.

- Ease of Access: Buy and sell shares with just a few clicks.

- Especially for Overseas Nepalis: Online platforms remove the geographical barrier, allowing you to invest in Nepal from wherever you are.

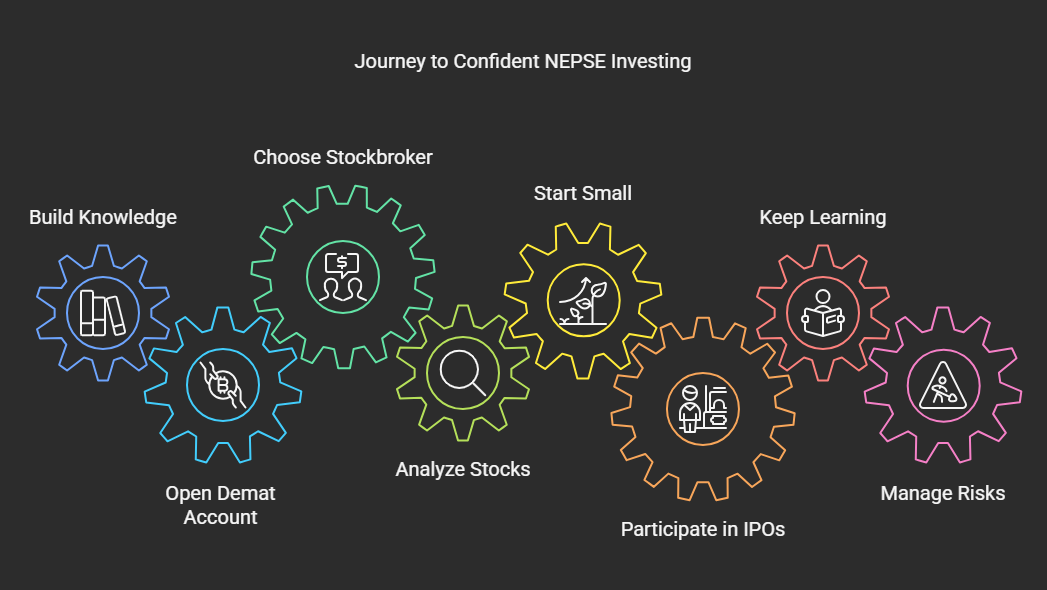

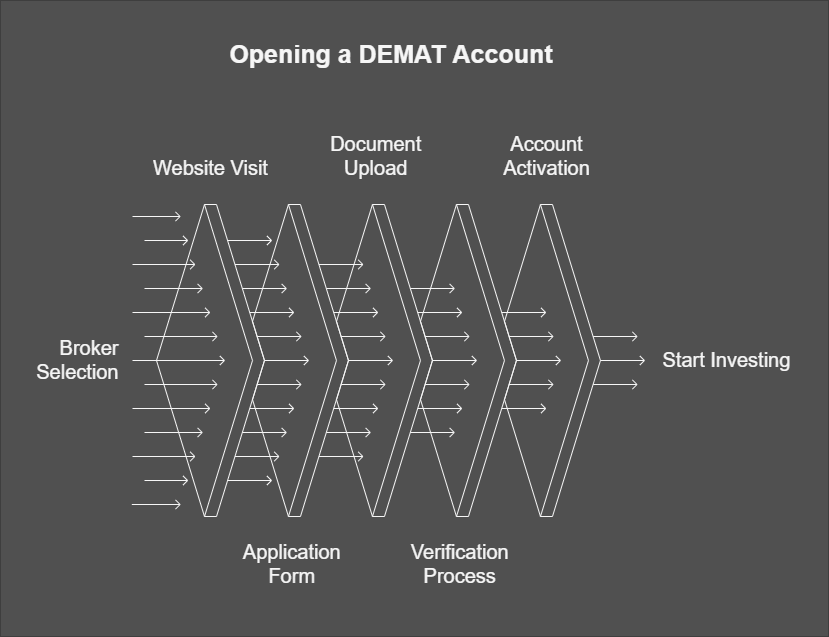

How to open a DEMAT account online (General Steps):

While specific requirements might vary slightly between different brokers, here’s a general outline of the online DEMAT account opening process:

- Choose a Broker: Research and select a reputable stockbroker registered with the Securities Board of Nepal (SEBON) that offers online account opening for NRIs/Overseas Nepalis. Look for user-friendly platforms and good customer support. Companies like Naasa Securities and Capitalmax are worth considering.

- Visit their Website: Go to the broker’s official website and look for the “Open an Account” section.

- Fill out the Online Application Form: Provide your personal details, including your name, address (both overseas and permanent Nepali address), contact information, PAN number (if available), and other necessary information.

- Upload Documents: You’ll typically need to upload scanned copies of the following documents:

- Passport: Showing your Nepali citizenship.

- Visa/Residence Permit: Proof of your current residency abroad.

- Passport-sized Photographs: Recent photographs.

- Proof of Nepali Address: Citizenship certificate, land ownership documents, or utility bills in your name or a close family member’s name.

- PAN Card (if available): This is highly recommended for tax purposes.

- Bank Statement (Overseas and/or Nepal): To verify your financial standing.

- Online Verification (Sometimes Required): Some brokers may conduct a video KYC (Know Your Customer) process for further verification.

- Account Activation: Once your application and documents are verified, your DEMAT account will be activated. You’ll receive your login credentials via email.

- Fund Your Account: Transfer funds from your bank account (either in Nepal or overseas, depending on the broker’s options) to your trading account.

- Start Investing! Explore the Nepali stock market, research companies, and make informed investment decisions.

Tips for Overseas Nepalis:

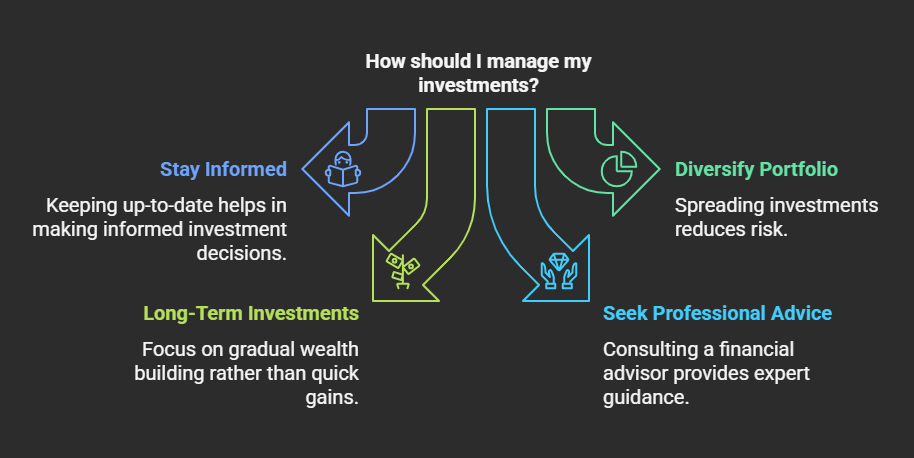

- Stay Informed: Keep up-to-date with the latest news and developments in the Nepali economy and stock market.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Spread your investments across different sectors and companies.

- Consider Long-Term Investments: Focus on building wealth over the long term, rather than chasing quick profits.

- Seek Professional Advice: If you’re unsure about investing, consult with a financial advisor.

Investing in the Nepali market can be a rewarding experience, but it’s important to do your research and understand the risks involved. With a DEMAT account, you can easily participate in the growth of the Nepali economy and build a secure financial future for yourself and your loved ones.

So, what are you waiting for? Take the first step towards your financial goals today!

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor before making any investment decisions.

Let me know in the comments: What are your thoughts on investing in the Nepali market? Do you have any questions about DEMAT accounts? I’m here to help!

P.S. Share this post with your fellow Nepali friends and family who might find it helpful. Let’s spread the word about investing wisely!

RELATED POSTS

View all