The Nepal Stock Exchange (NEPSE) showcased a dynamic performance this week, reflecting a surge in investor activity and optimism. For the week ending December 7, 2024, NEPSE recorded a significant trading volume of NPR 45.396 billion, an impressive increase of NPR 6.407 billion compared to the previous week. This uptick highlights growing investor confidence and a robust trading environment.

Get the key highlights of NEPSE’s performance for the week.

- Range-Bound Trading:

NEPSE continued its trend of trading within the 2780-2614 range, which has persisted for the past seven weeks. This indicates a period of consolidation as market participants await a potential breakout or correction. The steady oscillation suggests the market is searching for direction amidst mixed sentiment. - Increased Trading Volume:

This week’s total trading volume exceeded NPR 45 billion, a notable rise from last week’s figure of NPR 38.989 billion. The surge in trading activity could be attributed to increased participation by institutional investors and retail traders, as well as favorable economic indicators. - Sector Performance:

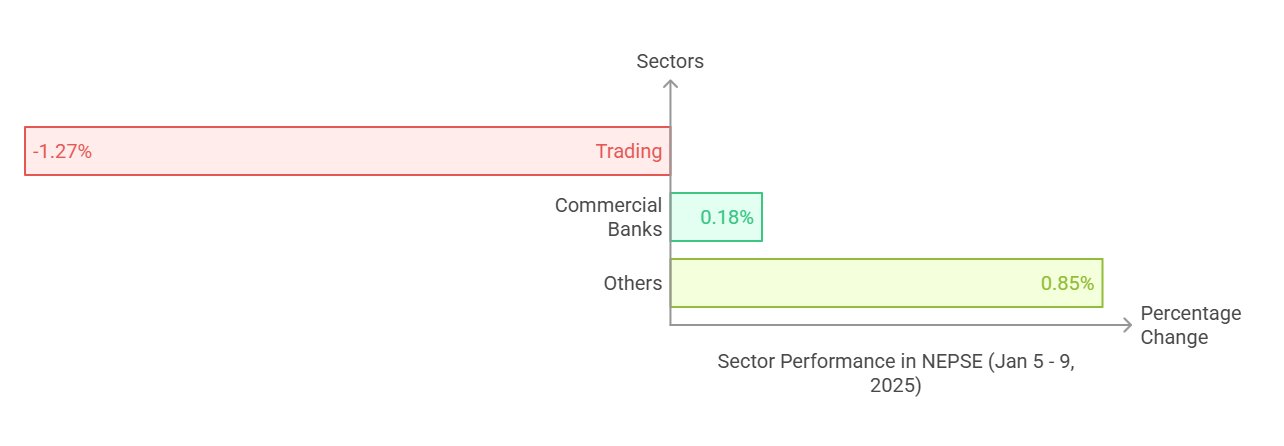

- Commercial Banks: Continued to dominate trading activity, maintaining their position as the backbone of NEPSE. Several banks reported strong quarterly results, boosting investor confidence.

- Insurance: The insurance sector witnessed mixed performances, with a few companies rallying on expectations of regulatory reform.

- Hydropower: Hydropower stocks saw heightened volatility, driven by recent government announcements regarding energy exports.

- Development Banks and Microfinance: These sectors remained relatively stable, showing modest gains amid selective buying.

- Index Performance:

Although NEPSE traded in a tight range, mid-week rallies were observed, driven by positive macroeconomic news and the release of promising corporate earnings. However, profit-taking towards the end of the week capped gains.

Market Sentiment Analysis

The consistent range-bound behavior suggests that traders are closely monitoring key resistance and support levels. A breakout above 2780 could signal the beginning of a bullish trend, while a dip below 2614 might trigger a bearish sentiment.

Factors influencing market sentiment include:

- Economic Policies: Investor reactions to recent government policies on taxation and infrastructure development.

- Foreign Investment: Increasing foreign participation in certain sectors is boosting overall liquidity in the market.

- Global Market Trends: Nepal’s stock market is partially influenced by the performance of regional markets, particularly India.

Key Levels to Watch Next Week

- Resistance: 2780 – A breakout above this level could push the index higher and attract fresh buying.

- Support: 2614 – Sustained movement below this level might indicate further downside risk.

Conclusion

NEPSE’s performance this week demonstrates a strong trading environment, with rising volumes and stable price movements. As the market remains range-bound, investors are advised to exercise caution, keeping an eye on macroeconomic developments and sector-specific trends. Whether NEPSE breaks out or continues its consolidation phase in the coming weeks will depend on external and internal market forces.

RELATED POSTS

View all