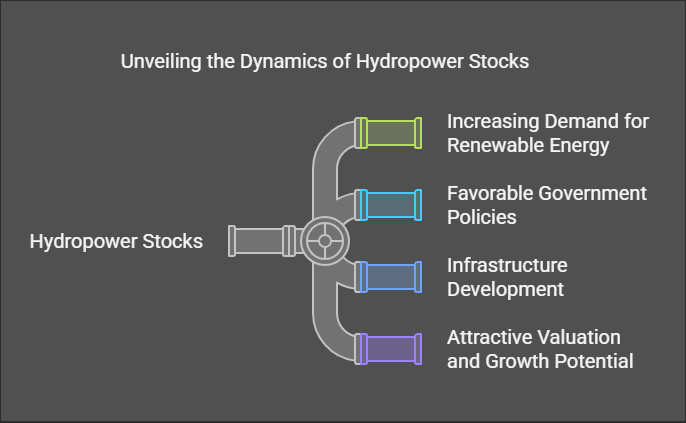

Hydropower stocks are currently making waves in the Nepal Stock Exchange (NEPSE), capturing the attention of investors seeking growth opportunities. This document explores the reasons behind the surge in hydropower stocks and how they can potentially enhance your investment portfolio. With the increasing demand for renewable energy and favorable government policies, hydropower companies are positioned for significant growth, making them an attractive option for investors.

The Growing Demand for Renewable Energy

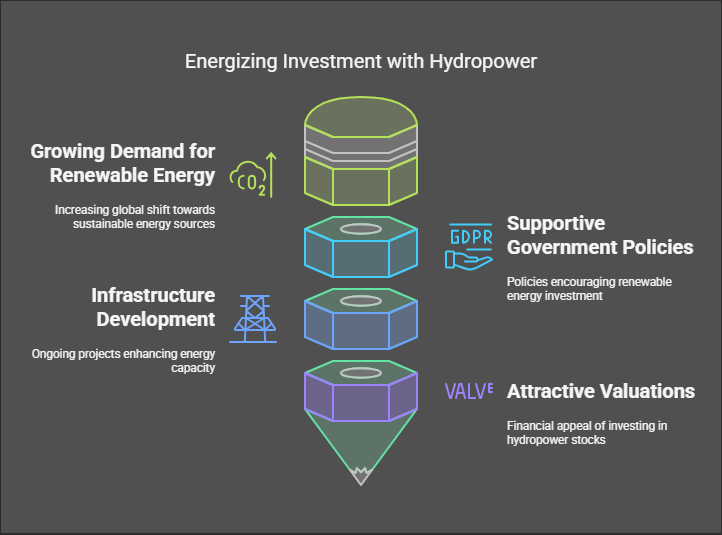

As the world shifts towards sustainable energy sources, hydropower stands out as a reliable and efficient option. Nepal, endowed with abundant water resources, has immense potential for hydropower generation. The global push for renewable energy has led to increased investments in this sector, driving up the value of hydropower stocks on NEPSE.

Government Support and Policies

The Nepalese government has been actively promoting hydropower development through various policies and incentives. Initiatives such as tax exemptions, subsidies, and streamlined licensing processes have created a conducive environment for hydropower projects. This support not only boosts investor confidence but also enhances the growth prospects of hydropower companies listed on NEPSE.

Infrastructure Development

Significant investments in infrastructure, including roads and transmission lines, are crucial for the successful operation of hydropower projects. The ongoing development of infrastructure in Nepal is expected to facilitate the growth of the hydropower sector, making it an attractive investment opportunity. Improved connectivity will enable better access to remote hydropower sites, further enhancing production capabilities.

Attractive Valuation and Growth Potential

Many hydropower stocks on NEPSE are currently undervalued, presenting an opportunity for investors to capitalize on their growth potential. As these companies expand their operations and increase their production capacity, their stock prices are likely to rise. Investors looking for long-term growth may find hydropower stocks to be a compelling addition to their portfolios.

Conclusion

In conclusion, hydropower stocks are electrifying NEPSE due to the growing demand for renewable energy, supportive government policies, ongoing infrastructure development, and attractive valuations. As the world continues to embrace sustainable energy solutions, investing in hydropower stocks could be a strategic move to power up your portfolio. With the right approach, investors can harness the potential of this dynamic sector and enjoy the benefits of a greener future.

Key Points:

- Focus on the surge in hydropower stocks like Upper Tamakoshi and Chilime Hydropower.

- Government policies promoting renewable energy and their impact on stock prices.

- Risks and rewards for investing in hydropower companies.

RELATED POSTS

View all