Mastering NEPSE: Simplified Stock Analysis for Smarter Investments in Nepal

January 6, 2025 | by Nepal Majhi

Unlock smarter investments in Nepal with simplified NEPSE stock analysis. Master trends, insights, and strategies to make confident market moves today!

Hey there, fellow investor!

Have you ever stared at the NEPSE (Nepal Stock Exchange) charts, feeling overwhelmed by all those numbers, lines, and jargon? Trust me, you’re not alone. Investing in the stock market can feel like decoding a secret language—but it doesn’t have to be that way.

Let’s take a deep breath and simplify things together. By the end of this blog, you’ll have a clear understanding of how to analyze stocks on NEPSE and make smarter investment decisions. Ready? Let’s dive in!

Why Simplified Analysis Matters

First things first: you don’t need a degree in finance to succeed in the stock market. What you need is a solid strategy and the ability to understand a few key metrics. Simplicity is your best friend here. When you keep your analysis simple, you’re more likely to stick to it and less likely to get lost in the noise of market fluctuations.

Step 1: Understand the Basics

Before we dive into analysis, let’s get comfortable with some essential terms:

- Market Capitalization: This is the total value of a company’s shares. Think of it as the company’s size.

- Small-cap stocks: Riskier but with higher growth potential.

- Large-cap stocks: Safer but slower growth.

- P/E Ratio (Price-to-Earnings Ratio): This tells you if a stock is overvalued or undervalued. Lower ratios often mean better value.

- Dividend Yield: If you love passive income, look for companies with a steady dividend yield.

Take a moment to jot these down; they’ll come in handy!

Step 2: Analyze the NEPSE Index

The NEPSE index gives you a bird’s-eye view of how the overall market is performing. If the index is trending upward, it’s generally a good sign. But don’t stop there—dive deeper into sectoral indices like:

- Banking: A dominant sector in NEPSE.

- Hydropower: Nepal’s energy backbone.

- Manufacturing & Processing: For those eyeing industrial growth.

Pro Tip: Keep an eye on macroeconomic factors like political stability and remittance inflow. These heavily influence NEPSE’s performance.

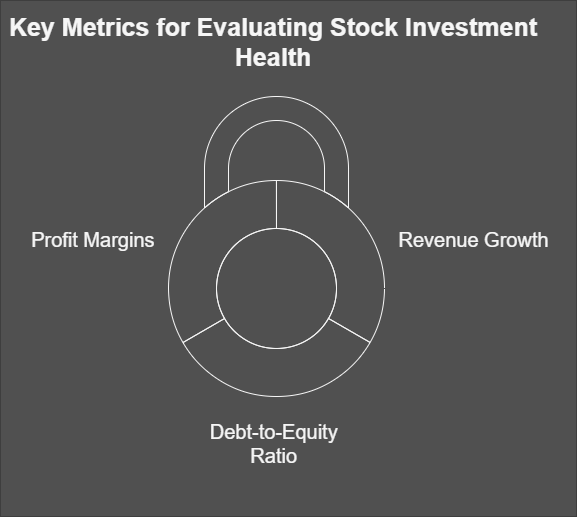

Step 3: Fundamental Analysis Made Easy

Now, let’s get to the meat of stock analysis: fundamentals. Here’s a quick checklist:

- Revenue Growth: Is the company earning more money year after year?

- Debt-to-Equity Ratio: A lower ratio indicates financial health.

- Profit Margins: Higher margins mean the company is efficient.

- Management Team: Research the people running the show. Are they trustworthy?

If a company ticks most of these boxes, it’s worth considering.

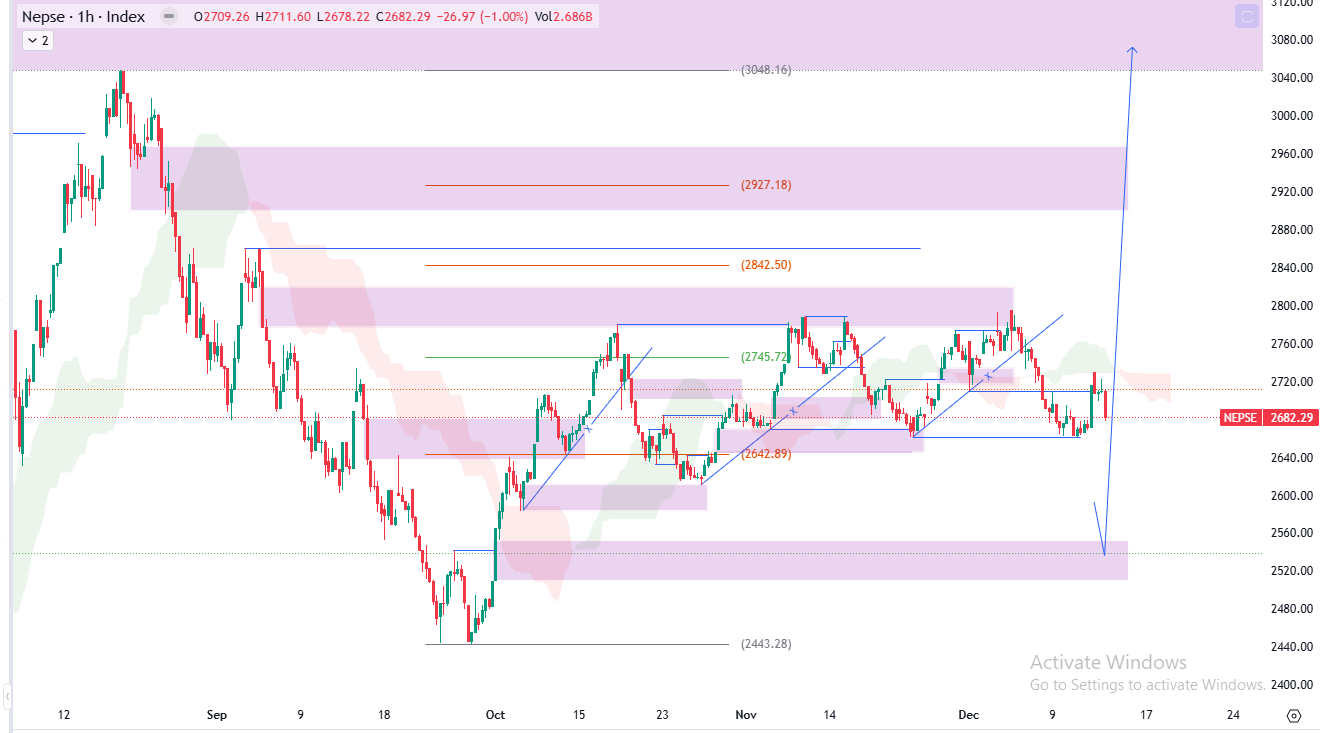

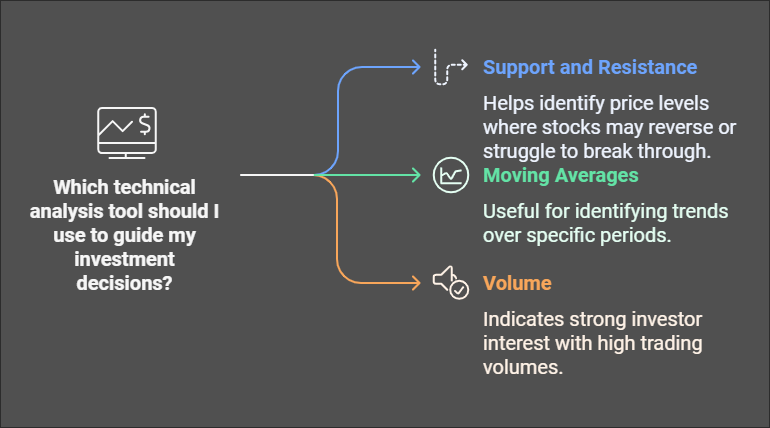

Step 4: Technical Analysis Without the Headache

For those who love charts, here’s a simplified approach to technical analysis:

- Support and Resistance Levels: These are price levels where a stock tends to bounce back or face difficulty breaking through.

- Moving Averages: Use the 50-day and 200-day moving averages to identify trends.

- Volume: High trading volumes often signal strong investor interest.

To understand and master the chart analysis Read here.

Pro Tip: Don’t overcomplicate it. Pick one or two indicators that make sense to you and stick with them.

Step 5: Diversify, Don’t Gamble

Putting all your money into one stock is like putting all your eggs in one basket. Instead, diversify your portfolio across different sectors. For example:

- 40% in banking stocks for stability.

- 30% in hydropower for growth.

- 20% in manufacturing for innovation.

- 10% in high-risk, high-reward small caps.

This way, you spread your risk while maximizing potential returns.

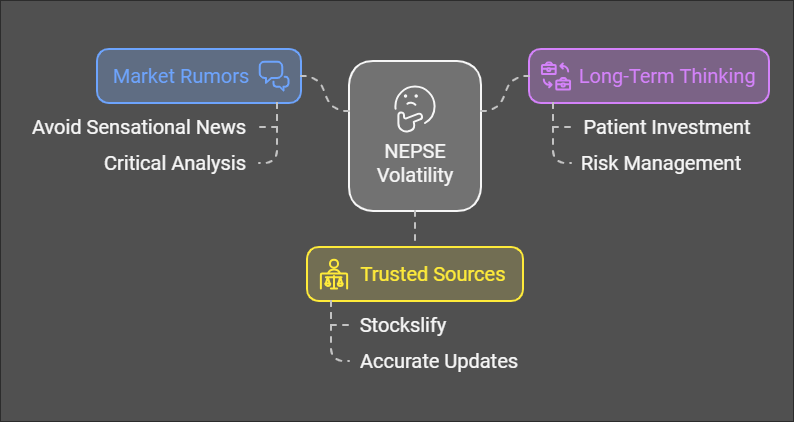

Step 6: Stay Updated but Stay Calm

NEPSE can be volatile, and it’s easy to get swayed by market rumors or sensational news. Remember, the best investors are those who think long-term. Use trusted sources like Stockslify for accurate and timely updates.

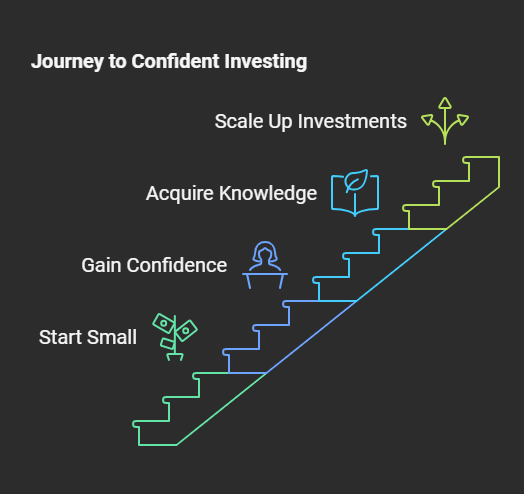

Final Thoughts: Start Small, Think Big

If you’re just starting out, it’s okay to begin with a small investment. Use it as a learning experience. Over time, as you gain confidence and knowledge, you can scale up. The key is to stay consistent and never stop learning.

What’s Next?

I’d love to hear your thoughts! What challenges have you faced while analyzing NEPSE stocks? Drop a comment below or connect with us on social media. Let’s grow smarter together—one investment at a time!

Happy investing, my friend. You’ve got this!

RELATED POSTS

View all